9 Frugal Living Hacks to Save $100 Every Month

Introduction

A few years ago, I realized my paycheck was vanishing faster than I thought. Rent, groceries, subscriptions, and “little treats” quietly drained my account before the month even ended. It wasn’t the big bills — it was the tiny leaks that silently added up.

That realization pushed me to try frugal living hacks that could help me save without feeling restricted. I didn’t want to be cheap — I wanted to be intentional. I wanted control.

Small tweaks soon turned into huge results. By changing just a handful of daily habits, I started saving more than $100 every single month. And surprisingly, I didn’t feel like I was sacrificing a thing.

These frugal living hacks completely changed how I handle money and helped me save money every month without giving up the things I enjoy.

If you’re ready to save smarter, not harder, here are nine frugal living hacks that can genuinely make a difference — starting this week.

These are simple ways to save money every month without giving up what you enjoy.

1) Track your spending daily — the most overlooked frugal living hack

When I first tracked every expense, I was shocked to find I’d spent $45 on “gas station snacks” in one month. That’s nearly an entire tank of gas!

How to start:

- Use a notes app, budgeting spreadsheet, or a simple paper log.

- Write down every single purchase for 30 days.

- Categorize them (needs vs wants).

According to the Federal Reserve’s 2023 Report on the Economic Well-Being of U.S. Households, only 48% of adults reported spending less than their income in the prior month — proof that tracking expenses still isn’t the norm.

Even skipping two $6 impulse buys per week saves nearly $50/month.

💡 Quick Tip: Turn it into a mini challenge — “No Spend Week.” You’ll be surprised how awareness alone changes behavior.

📖 Also read: Personal Finance 101: Money Habits Every Beginner Should Master

2) Plan meals instead of guessing

Walking into a grocery store without a plan is like shopping blindfolded. I used to grab extras “just in case,” and half ended up wasted. Now, I spend 15 minutes each Sunday making a frugal living meal plan.

Example weekly plan:

Mon – Chicken stir-fry with rice

Tue – Lentil soup with bread

Wed – Tacos with beans and salsa

Thu – Leftovers or freezer meal

Fri – Pasta with tomato sauce

When I started doing this, my grocery bill dropped by $60 in the first month. The reason? Less waste and fewer “emergency takeouts.”

According to the USDA, food costs take up 9–12% of the average household income. Planning your meals cuts that dramatically — and it also reduces stress.

💡 Frugal Living Tip: Try “theme nights” (Meatless Monday, Leftover Thursday). You’ll save time and reduce decision fatigue.

Meal planning is one of the simplest frugal living hacks and proves you can live well and still save money every month.

👉 See also: Beginner’s Guide to Freezer Meals That Save Time and Money

▶️ How I Save $100 Every Month (9 Frugal Hacks That Actually Work)

See these 9 frugal hacks in action — practical, real-life ways to save money without giving up what you love.

3) Brew coffee at home (without losing the café vibe)

That $5 latte habit can easily become a $1,200 annual expense. Brewing at home cuts that to under $20 per month — and still feels indulgent.

Invest in a French press or an AeroPress. Use good beans and a reusable cup. Create your own “coffee corner” at home — it’s a small ritual that starts your day calm and collected.

Even if you still visit your favorite café once a week, you’ll still save $60–$80 a month. That’s your streaming subscription, gym membership, or emergency fund contribution right there.

💡 Quick Tip: Reinvest your “coffee savings” into a savings goal — use a digital envelope app like YNAB or Qube to visually track it.

4) Audit subscriptions every 3 months

I once found three forgotten apps quietly charging me $28/month — music, fitness, and cloud storage I hadn’t used in months.

Frugal fix:

- Check your bank or PayPal statements every 3 months.

- Highlight recurring charges.

- Cancel or pause what you don’t use.

A 2022 C+R Research study found Americans underestimate subscription costs by 197%. That’s why this simple habit can free up $20–$40 per month immediately.

💡 Frugal Living Tip: Bundle where possible — streaming, phone, and even insurance providers often give multi-service discounts.

5) Buy second-hand first

One of my best wins was finding a $220 office chair for $40 on Facebook Marketplace — practically new.

Look for furniture, sports gear, kids’ clothes, and even home tools.

The key is to check before you buy new.

You can easily save hundreds over time — plus, it’s environmentally conscious.

Among all frugal living hacks, buying second-hand first offers both financial and environmental benefits.

The EPA notes that buying second-hand reduces landfill waste and lowers production demand.

Frugality and sustainability go hand in hand.

💡 Related: The Frugal Home: DIY Fixes and Upgrades That Save You Money

6) Cook in bulk and freeze leftovers

Meal prepping is one of the simplest frugal living hacks that pays off immediately.

One Sunday, I made double the amount of chili and froze half. The next week, when I was tempted to order takeout, that frozen batch saved me $30.

Steps:

- Pick meals that freeze well (soups, curries, casseroles).

- Label and portion them in freezer-safe containers.

- Rotate weekly — keeps meals interesting and avoids waste.

Replacing two takeouts per month = $50 saved.

Packing lunch three times per week adds ~$70 savings. You’re already at $120+ without even trying.

👉 Also read: Can You Really Feed a Family on $50 a Week?

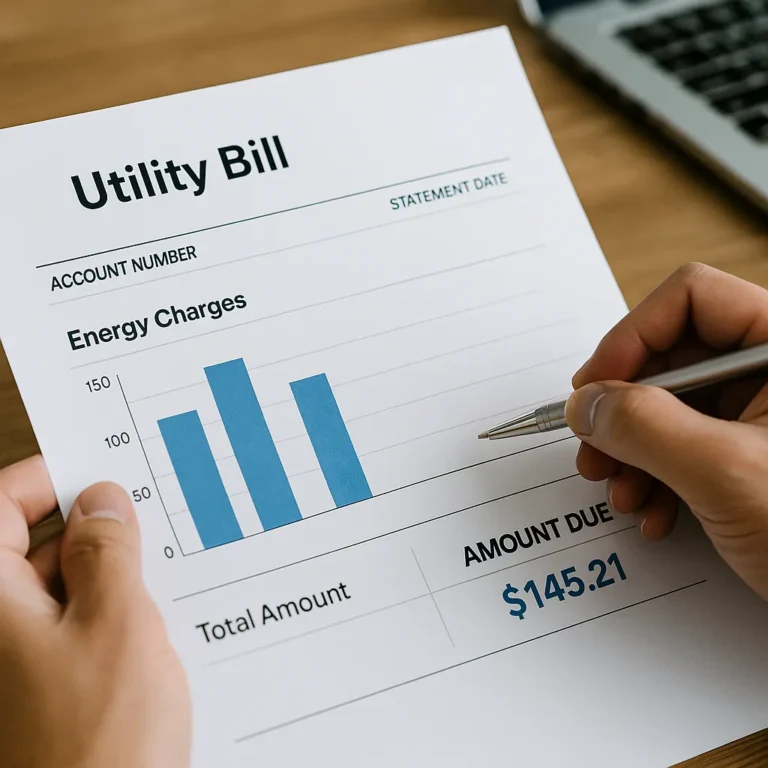

7) Cut energy waste at home

My power bill used to shock me — literally. After switching to LED bulbs, unplugging chargers, and using a smart strip, my costs dropped $18/month.

Other easy wins:

- Lower thermostat by 2°F.

- Wash laundry in cold water.

- Air-dry clothes when possible.

The U.S. Department of Energy says LEDs use up to 90% less energy and last 25× longer.

A few small energy-efficient habits can reduce your bill by up to 15%.

💡 Quick Tip: Check if your local utility company offers free home energy audits — many do, and it can uncover hidden savings.

8) Use cashback and rewards wisely

If you’re already spending, earn something back. Cashback isn’t just for big spenders — it’s free money for smart buyers.

Start with one cashback app (Rakuten, Ibotta, Upside). Use a credit card offering 3–5% on essentials only if you pay in full.

A 2023 Bankrate survey found that nearly 23% of rewards cardholders didn’t redeem any of their rewards in the past year — that’s billions of dollars left unclaimed.

Stacking rewards with loyalty programs and digital coupons can easily bring $30–$50 a month in passive value.

💡 Pro Tip: Set a “cashback goal.” Use rewards to pay for holiday gifts or next month’s groceries — instant motivation.

9) DIY instead of paying for services

I once paid $120 for a house cleaning that took two hours. The next month, I did it myself and used the savings for an emergency fund deposit.

DIY doesn’t mean doing everything — it means learning where you can.

Painting, lawn care, small repairs, or basic maintenance can save hundreds per year.

⚠️ Safety Tip: Leave electrical or gas work to professionals.

The Bureau of Labor Statistics shows the average U.S. household spends over $3,600 annually on services — a goldmine of potential savings.

Every DIY project adds up, and the satisfaction of doing it yourself is priceless.

Practicing these frugal living hacks consistently is how ordinary people build lasting financial freedom.

Quick wins — frugal living hacks you can try today

Here are proven money tips that make saving easier and more practical.

- Cancel one unused subscription.

- Put $50 into a savings jar right now.

- Create a “use-first” bin in the fridge to stop food waste.

- Unsubscribe from 3 retail newsletters.

- Apply the 48-hour rule before buying anything non-essential.

- Swap one takeout for a home-cooked meal tonight.

💡 Frugal Living Tip: Track these small wins in a note or app. Seeing progress motivates you to keep going.

Conclusion & Next step

Frugal living isn’t about deprivation — it’s about direction.

It’s choosing where your money goes and making it work for you.

By following these frugal living hacks, you’ll see how to save money every month with real results.

By trying even a few of these frugal living hacks, you’ll start to see real results within weeks — not months. Small actions, like planning meals or tracking expenses, compound into lasting freedom.

If you stick with these frugal living hacks, you’ll notice more money staying in your account each month.

👉 Next Step:

- Pick one hack and apply it today.

- Track your savings for a week.

- Reinvest those savings into a small goal — debt payoff, emergency fund, or your next mini-vacation.

✨ Remember: every dollar saved is a small piece of freedom earned.

👉 Next read: Minimalist Money: How Minimalism Helps You Save and Build Wealth

Common Questions About Frugal Living

Is frugal living the same as being cheap?

Not at all. Frugal living is about being intentional with your spending, not avoiding it altogether. Cheap habits focus only on price, while frugal habits focus on value. Buying a high-quality appliance that lasts ten years is frugal; buying the cheapest one that breaks after a year is not. Frugality means spending where it matters and cutting costs where it doesn’t — using money wisely to align with your real priorities.

How can I start frugal living if I’ve never budgeted before?

Start small. Track every expense for 30 days — awareness is the first frugal living hack that changes everything. Then identify your top three spending leaks (like eating out, unused subscriptions, or impulse shopping). Replace one habit per month: cook at home, cancel one subscription, or make coffee yourself. As you see progress, set simple goals — saving your first $100, then $300, and beyond. Over time, you’ll build lasting money habits that make saving effortless. It’s perfect budgeting for beginners who want to start small and stay consistent.