Black Friday on a Budget: 7 Rules to Avoid Overspending

Introduction

Two years ago, a friend of mine lined up outside a department store at midnight for a Black Friday deal on a flat-screen TV. He swore he’d only get that one item. By sunrise, though, he left with the TV, a gaming console, a coffee machine, and even a smartwatch. His Black Friday budget? Completely wiped out. Later, he admitted, “I felt like if I didn’t grab things fast, I’d miss out.”

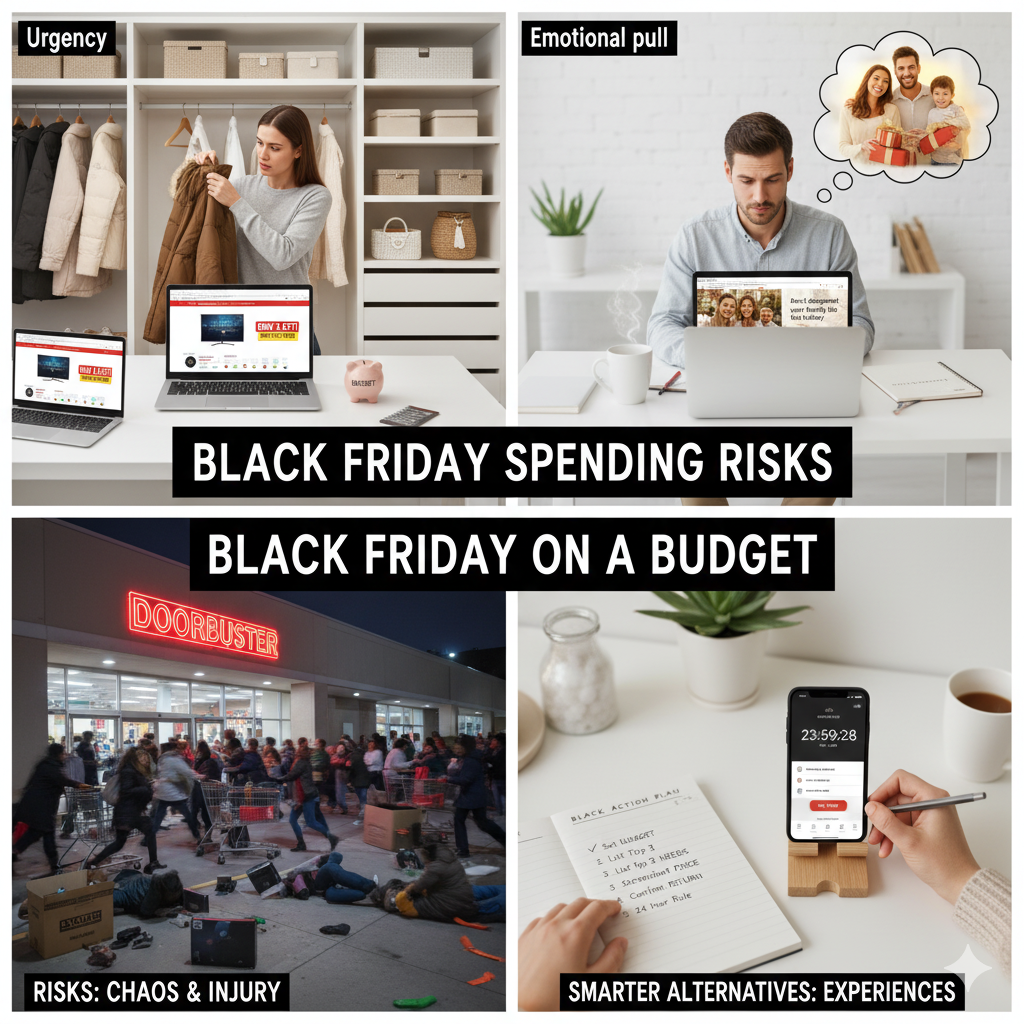

If that sounds familiar, you’re not alone. Retailers design Black Friday to pull you in with urgency and hype. And while it can be exciting, it comes with Black Friday spending risks—not just to your wallet, but also your safety. There have been tragic cases of injuries and even deaths during chaotic store openings.

This article lays out 7 Black Friday shopping tips to help you avoid overspending Black Friday, protect your money, and enjoy smart holiday shopping without regret.

Why Black Friday Spending Gets Out of Control

Retailers use powerful psychological triggers:

- Urgency: “Only 3 left at this price!”

- Scarcity: “Doorbuster deal until 10 AM only!”

- Emotional pull: “Don’t disappoint your family this holiday.”

According to the National Retail Federation (NRF), an estimated 197 million consumers shopped during the 2024 Thanksgiving–Cyber Monday weekend, setting a record (NRF press release). Adobe also reported that U.S. online holiday spending reached $241.4 billion in 2024, up 8.7% year-over-year (Adobe holiday report).

That scale creates an environment where your Black Friday budget feels like a flimsy defense. Ads, crowd energy, and endless online notifications all push you to spend more. Without a plan, it’s almost impossible to resist.

👉 Quick Tip: Recognize the trap early. If a deal looks too good, search its price history first before letting your emotions decide.

For more strategies on everyday savings, check out my guide on 9 frugal living hacks that save $100 every month.

7 Black Friday Budget Rules

1. Set a Hard Spending Cap Before the Ads Arrive

Think of your Black Friday budget as your armor. Decide the exact amount you’ll spend and don’t exceed it.

- Use a prepaid card or separate account to limit temptation.

- Split funds: 70% for essentials, 20% for gifts, 10% for “fun splurge.”

📖 Story: One of my readers capped her spending at $250. She stuck to her list, bought what she needed, and ended the weekend with $20 left over. No debt, no stress.

2. Make a Needs List (and Stick to It)

Impulse is the biggest enemy. Write a needs list before Black Friday and keep it visible.

- Examples: winter coats, replacement electronics, pantry staples.

- Non-examples: “That shiny gadget everyone is talking about.”

👉 Quick Tip: Put the list in your phone notes so you can’t “forget” it.

When tempted to buy new appliances or gadgets, consider whether a repair would do. My article on DIY fixes and simple home upgrades shows how small projects can save big money.

3. Research Price History and Unit Costs

Many “discounts” are illusions. According to Consumer Reports, some items are marked up before Black Friday to make discounts look bigger.

- Use CamelCamelCamel or Honey to check price history.

- Bulk items aren’t always cheaper—compare unit costs carefully.

📖 Personal Note: I nearly bought a “half-off” printer one year. A quick search revealed it had sold for that price for weeks. I walked away and saved $120.

4. Compare Stores and Bundle Shopping Trips

Shoppers often overspend not just money, but time and energy. A $15 saving isn’t worth two hours in traffic.

Checklist for smart comparisons:

- Factor in total cost of ownership (TCO): shipping, gas, and returns.

- Use price-match policies—many stores honor competitor prices if you show proof.

- Keep carts open in two browsers to compare final checkout costs.

- Check product revisions—“discounted” items may be older or refurbished.

📖 Example: Best Buy often offers “open-box” deals on electronics during Black Friday. They may look cheaper, but warranty coverage is shorter compared to brand-new items. Target, on the other hand, sometimes includes gift cards with purchases—a better value if you shop there regularly.

For perspective on stretching every dollar, see how I planned a family’s meals for just $50 a week—the same principle applies to shopping: look at cost per unit and hidden fees.

5. Apply the One-In, One-Out Rule

Minimalism is a hidden money-saving hack. For every purchase, let go of something else.

- New jacket → donate the old one.

- New laptop → sell or recycle your old device.

- New holiday décor → gift or repurpose last year’s items.

📖 Story: A subscriber told me she bought boots last year but donated two older pairs. She felt lighter—and realized she didn’t need more stuff after all.

If you’re curious how this mindset impacts your finances, check out my piece on minimalist living and saving money.

6. Double-Check Return Policies (They Change on Black Friday)

Holiday season = stricter return rules. Many shoppers are surprised later.

- Electronics may have 10–15% restocking fees.

- Return windows may shrink from 30 to 14 days.

- “Final sale” labels = no refunds.

📖 Example: Best Buy charges up to 15% restocking fees on certain electronics, while Amazon typically offers 30-day returns on most products even during the holidays. These differences can make or break a deal.

👉 Caution: Always snap a photo of receipts. A five-second habit can save hours of frustration later.

👉 Key Insight: Confirming policies before checkout is one of the easiest ways to avoid overspending Black Friday and regret-buying.

7. Wait 24 Hours Before Major Purchases

The most effective of all Black Friday shopping tips: sleep on it.

- Leave items in your cart for 24 hours.

- If it still fits your Black Friday budget, buy it.

- If not, you’ve just saved money.

📖 Story: One reader paused on an $800 TV. The next day, she realized her old one worked fine. Instead, she used the money for a weekend getaway her kids still remember.

This “pause” principle connects with digital life too—see how I explained the trade-offs in Minimalist Money: How Minimalism Helps You Save and Build Wealth.

The Hidden Risks of Black Friday

It’s not just about overspending. Since 2008, watchdog trackers and media reports have documented tragic incidents—over a dozen deaths and more than a hundred injuries—linked to Black Friday runs.

- Doorbuster stampedes

- Parking-lot fights

- Sleep-deprived drivers rushing to stores

👉 Caution: No discount is worth risking your wellbeing. Shop during off-peak hours or online whenever possible.

Smarter Alternatives to Black Friday Shopping

If the chaos feels overwhelming, you’re not out of options:

- Secondhand markets: lightly used electronics, clothes, or furniture.

- Experience gifts: cooking classes, concerts, or family trips.

- Community tool libraries: borrow instead of buy.

For more seasonal spending trends, see the NRF Holiday Spending Trends.

Final Thoughts: Shop Smart, Stay Safe

Black Friday can be a money-saver or a money-pit—it depends on your plan. With a solid Black Friday budget, a needs list, awareness of return policies, and the 24-hour rule, you’ll avoid overspending Black Friday and shop with intention.

👉 Action Plan Before You Shop

- Write down your Black Friday budget number.

- List your top 3 needs—ignore everything else.

- Screenshot price history before buying.

- Confirm return policies upfront.

- Apply the 24-hour rule to big purchases.

If you’re ready to go deeper, explore related guides:

- Learn how to save $100 every month with 9 frugal living hacks

- Discover how minimalist living can save you more

- Find out how DIY home fixes cut costs

For a broader look at holiday shopping behavior, see Adobe’s Holiday Shopping Report.

FAQs About Black Friday Shopping

1. How much does the average shopper spend on Black Friday?

According to NRF, the average U.S. consumer spent about $430 over Black Friday weekend 2023, and 2024 set records with nearly 197 million shoppers joining in. These numbers highlight the scale of Black Friday—if you don’t set a firm black friday budget, it’s easy to overspend. Always remember that your financial wellbeing is more important than keeping up with crowd-driven spending.

2. Are Black Friday deals really worth it?

Some are—but many discounts are inflated or matched at other times of year. Adobe’s reports show that some items see their lowest prices closer to Cyber Monday or even January clearance sales. The smartest shoppers use black friday shopping tips like tracking price history and comparing across stores. The bottom line: deals are worth it only if they fit within your budget and fulfill a real need.

3. What are the biggest risks of Black Friday shopping?

The obvious one is overspending, but black friday spending risks go beyond money. Crowds can cause stress or even physical danger, as seen in past stampedes. Online, phishing scams and fake stores also rise sharply during the season. Protect your budget and your safety: shop trusted retailers, avoid sketchy sites, and never let urgency override common sense.

4. How can I make sure I don’t regret my purchases?

Use the 24-hour rule: leave items in your cart and revisit them the next day. If they still feel worth it, buy them. If not, you’ve avoided a regret. Pair this with the one-in, one-out rule from minimalism—every new purchase replaces an old one. This method keeps both your home and your finances in balance, turning smart holiday shopping into a long-term habit.

5. What’s the best alternative to Black Friday shopping?

If you don’t enjoy the frenzy, there are many alternatives: secondhand markets, experience-based gifts, or simply waiting for January clearance. Many frugal families find that they save more by avoiding impulse-driven holiday shopping altogether. Instead of chasing black friday deals on a budget, focus on value-driven purchases that align with your financial goals. That’s the true essence of frugal and minimalist living.