9 Frugal Living Hacks to Save $100 Every Month

Introduction

A few years ago, I was shocked to see how quickly my paycheck disappeared. Rent, groceries, subscriptions, and small “treats” drained my account before the month was over. It wasn’t the big expenses that hurt most — it was the quiet leaks. A coffee here, a forgotten subscription there, and suddenly I was short.

That was my turning point. I decided to experiment with frugal living. I didn’t want to be cheap or deny myself everything; I wanted to be intentional. The result? Small changes snowballed into big savings. By combining just a few smart habits, I now save well over $100 each month without feeling deprived.

Here are nine frugal living hacks that can help you do the same.

1) Track Your Spending Daily

When I first tracked every expense, I realized $45 of my money went to “gas station snacks” in one month. It was a wake-up call.

How to start:

- Use a notes app, spreadsheet, or even a sticky note.

- Write down every purchase for 30 days.

This simple habit builds awareness. According to a 2023 survey by U.S. Bank, over 54% of Americans don’t use a budget — which explains why small leaks often go unnoticed. If logging makes you skip just two $6 impulse buys per week, that’s nearly $50/month saved.

2) Plan Meals Instead of Guessing

Walking into the store without a list is like shopping blind. I used to grab extras “just in case,” and food spoiled in the fridge. Now, I spend 15 minutes on Sunday writing a meal plan.

Example weekly plan:

- Mon: Chicken stir-fry with rice

- Tue: Lentil soup with bread

- Wed: Tacos with beans and salsa

- Thu: Leftovers or freezer meal

- Fri: Pasta with tomato sauce

By swapping just one $25 takeout per week with a planned dinner, you save $100/month.

And you’re not alone: the USDA reports that the average American household spends 9–12% of their income on food, much of it inflated by eating out.

💡 See also: Beginner’s Guide to Freezer Meals That Save Time and Money

3) Brew Coffee at Home

I loved my morning coffee run. But $5 × 20 workdays = $100/month. The math finally convinced me to change.

Now, I use a French press. My coffee costs about $0.40 per cup, and I enjoy the calm ritual before work. Even if I still treat myself to a café latte once a week, I save $60–$80/month.

According to Statista, the average American spends $1,100 per year on coffee — proof that this one habit can make a huge impact.

4) Audit Subscriptions Quarterly

One evening, I noticed two music apps and a fitness app quietly charging me. Together, they cost $28/month — for services I barely touched.

Frugal fix: Every 3 months, open your bank statement. Highlight recurring charges. Cancel, pause, or switch to bundles like Disney+/Hulu/ESPN.

Just canceling two $10 apps and one $15 free trial can free up ~$35/month. Quick, painless, and effective.

And it’s not unusual — a 2022 C+R Research study found that the average American underestimates subscription spending by 197% because charges are so easy to forget.

5) Buy Second-Hand First

One of my best wins: I found an ergonomic chair on Facebook Marketplace for $40. The same model cost $220 brand new. It was practically unused.

Check second-hand options for furniture, sports gear, tools, and kids’ clothes. Not everything should be bought used (skip mattresses or worn shoes), but when it makes sense, the savings are huge. Even one good find can cover your $100 goal.

The Environmental Protection Agency (EPA) also notes that buying second-hand reduces waste — it’s not just frugal, it’s eco-friendly too.

6) Cook in Bulk and Freeze Leftovers

One Sunday, I made a double batch of chili. Half went into the freezer. A week later, when I was too tired to cook, that frozen chili saved me from ordering $30 delivery.

Steps:

- Pick a meal that scales (soup, curry, pasta).

- Double the recipe.

- Freeze in single-portion bags.

Replacing just two takeouts a month = $50 saved. Add three packed lunches per week from leftovers (~$72/month), and you’re easily past $100.

👉 Related: Can You Really Feed a Family on $50 a Week?

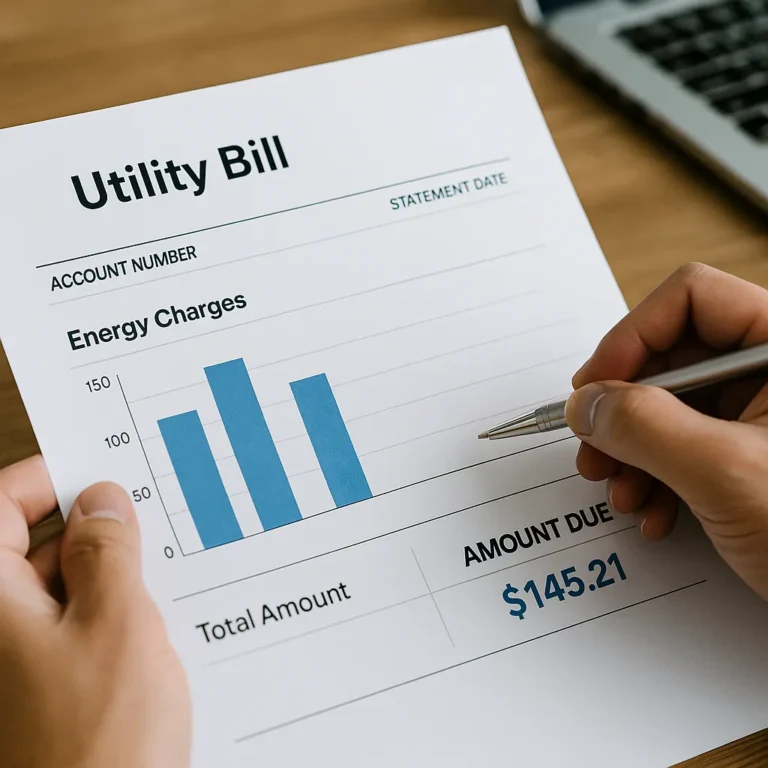

7) Cut Energy Waste at Home

I once wondered why my bill was so high. The culprit? Electronics drawing “phantom power” at night. After switching to a smart strip and unplugging chargers, my bill dropped $15.

Other small habits:

- Swap bulbs for LEDs.

- Adjust thermostat 2°F.

- Wash clothes in cold water.

The U.S. Department of Energy confirms that LED bulbs use up to 90% less energy than incandescent ones and can last 25 times longer. Together, these changes can save $10–$25/month.

8) Use Cashback and Rewards Wisely

If you’re already spending, why not earn something back?

- Install one cashback app like Rakuten or Ibotta.

- Use a credit card with 3–5% back (only if you pay in full).

- Stack store loyalty apps with digital coupons.

These strategies bring $20–$40/month for the average household.

A 2023 Bankrate report showed that 43% of U.S. credit card holders don’t redeem their rewards — free money left on the table.

9) DIY Instead of Paying for Services

I once paid $120 for a house cleaning that took two hours. The next month, I did it myself and put the money toward savings.

DIY works for: painting, mowing lawns, patching holes, even simple car maintenance.

Just one skipped cleaning or three lawn mows ($25 each) easily clears the $100/month mark.

⚠️ Safety note: leave electrical or gas work to professionals.

The Bureau of Labor Statistics notes that average household services (like cleaning, lawn care, minor repairs) can add up to hundreds per month, so every DIY choice matters.

Quick Wins You Can Try Today

- Cancel one unused subscription.

- Put $50 into savings right now.

- Unsubscribe from 3 retail emails.

- Create a “use-first” bin in the fridge.

- Apply the 48-hour rule before non-essential buys.

These tiny actions add up fast.

Conclusion

Frugal living isn’t about saying no to everything. It’s about saying yes to what matters most. By tracking expenses, planning meals, making coffee at home, or even cutting just one subscription, you’ll quickly find $100 or more back in your pocket every month.

Small choices stack into big results. Start with one or two hacks today, celebrate the savings, and watch your financial breathing room grow.

👉 Next read: Minimalist Money: How Minimalism Helps You Save and Build Wealth