Personal Finance 101: Money Habits Every Beginner Should Master

Money runs through every part of life — from paying rent to grabbing coffee on the way to work. But here’s the problem: most of us were never taught the basics in school. That’s why so many people feel lost when it comes to budgeting, saving, or paying down debt.

This guide is your personal finance 101 crash course. We’ll break down simple, beginner-friendly money habits you can start today, plus real-world examples that show why small choices matter. Think of this as the “frugal finance” playbook that sets you up for long-term freedom.

What Is Personal Finance (and Why It Matters)?

When people hear “personal finance,” they picture spreadsheets or boring lectures. In reality, it’s just how you handle your money every day.

It includes:

- Income: your paycheck, side hustles, freelancing gigs.

- Expenses: rent, utilities, food, streaming services.

- Saving & investing: setting money aside and growing it.

- Debt management: credit cards, loans, student debt.

- Protection: insurance, digital security.

💡 Quick note: If you’ve ever meal-prepped lunches 👉 Beginner’s Guide to Freezer Meals That Save Time and Money or cut your electric bill 👉 How to Cut Utility Bills: Simple Energy-Saving Tips, you’ve already taken your first step into frugal finance.

Step 1: Track Your Money

The first rule of personal finance 101 is simple: you can’t fix what you don’t measure.

How to track expenses effectively

- Card users: export monthly statements and highlight needs, wants, savings.

- Cash users: use the “receipt jar” trick — drop every receipt into a jar and log them weekly.

- Apps: Mint, YNAB, or even Google Sheets keep things tidy.

Example: A college student tracked her spending for one month. She discovered $120 going to late-night takeout. By cutting that in half, she saved $720 in six months — enough to cover a semester’s textbooks.

👉 Want to cut food spending even further? Check Smart Grocery Shopping Hacks That Cut Your Food Bill in Half.

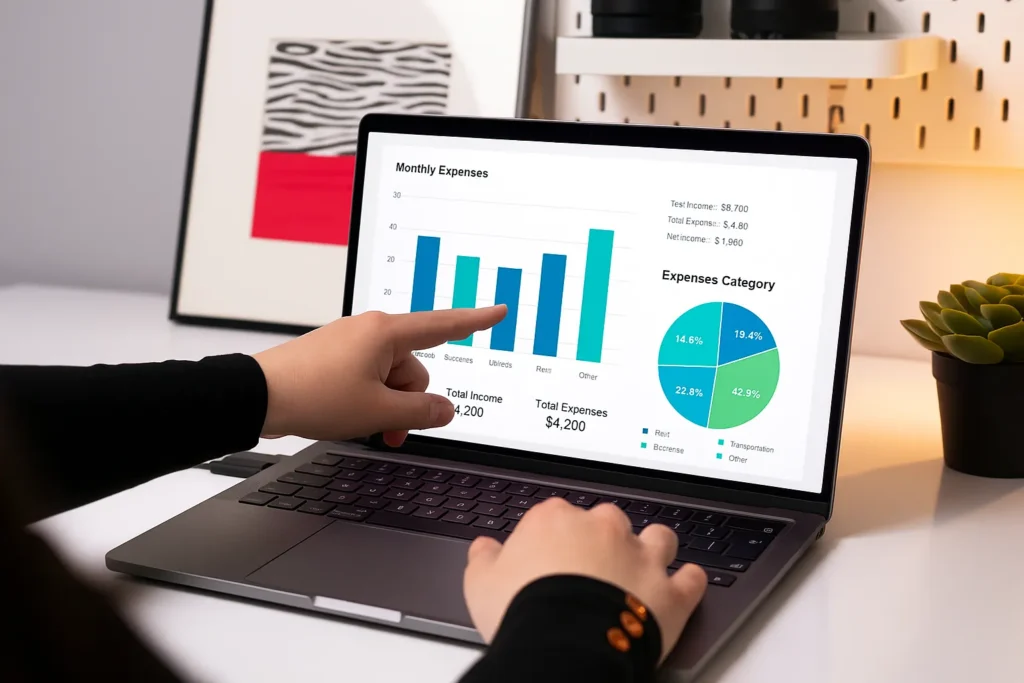

Step 2: Build a Beginner-Friendly Budget

A budget isn’t about saying “no” to everything fun. It’s about telling your money what to do so you can say “yes” to the things that really matter. That’s why many guides emphasize budgeting basics for beginners as a core financial step.

Budgeting basics for beginners

- 50/30/20 Rule → 50% needs, 30% wants, 20% savings/debt.

- Zero-Based Budgeting → Every dollar gets a job.

- Envelope Budgeting → Divide cash into envelopes labeled “groceries,” “gas,” “fun.”

Example: A newlywed couple used the envelope method for groceries. For the first time, they actually stayed under budget — and used the leftover cash to start an emergency fund.

👉 Curious about building better food plans on a budget? See Healthy Meal Planning on a Budget.

👉 External resource: NerdWallet – How to Budget Money: A Step-by-Step Guide.

Step 3: Create an Emergency Fund

Think of an emergency fund as your financial seatbelt. Without it, one flat tire or medical bill can push you into high-interest debt, which grows like a snowball rolling downhill. That’s why guides on how to build an emergency fund fast are so important for beginners.

How to build an emergency fund fast

- Starter goal: $1,000 for car repairs or surprise expenses.

- Next goal: 3–6 months of living expenses.

- Best place: high-yield savings accounts or money market funds.

Example: My coworker didn’t have an emergency fund. When her car broke down, she charged $900 to a credit card. After a year of minimum payments, the balance grew to $1,300.

👉 External resource: CFPB – An Essential Guide to Building an Emergency Fund.

Step 4: Manage Debt Before It Manages You

Debt isn’t just numbers — it’s stress and lost opportunities. The key is choosing the right debt payoff strategies for your situation.

Debt payoff strategies

- Snowball method: Pay the smallest balance first to build momentum.

- Avalanche method: Pay the highest-interest debt first to save more overall.

Example: A reader had three credit cards: $500, $2,000, and $4,000. She cleared the $500 card first. That small win gave her confidence, and within 18 months, she was debt-free.

👉 Looking for ways to boost income while paying debt? Try 7 Side Hustles That Pay Cash Instantly or 10 Micro Side Hustles You Can Do in Under an Hour.

Step 5: Build Money Habits That Stick

Wealth isn’t built on one-time decisions. It’s built on small money habits that repeat month after month.

Healthy money habits:

- Automate savings and bills.

- Cancel one subscription every month.

- Have a “money date” once a month to review goals.

- Use a separate account for long-term savings.

Example: A couple set up a $50 auto-transfer every payday. At the end of the year, they had $1,300 saved — without even thinking about it.

👉 For a mindset shift, check Minimalist Living: How Owning Less Saves You More.

Step 6: Save & Invest Early (Snowball in Your Favor)

Debt grows if you ignore it. Savings and investments grow if you start early. That’s the power of compounding. If you’ve ever wondered how to start investing with little money, the key is consistency, not size.

How to start investing with little money

- Begin with as little as $25/month into an index fund.

- Automate contributions.

- Use Dollar-Cost Averaging (DCA) — invest the same amount monthly regardless of market swings.

Example:

- Start at 25 → $100/month = $200,000+ by retirement.

- Start at 35 → Same $100/month = ~$100,000.

That 10-year delay costs six figures.

👉 External resource: Investopedia – Compounding Explained.

👉 Also read: Beginner’s Guide to Selling Digital Products as a Side Hustle — another way to diversify income before investing.

Step 7: Protect What You’ve Built

It’s not enough to earn and save. You also need to protect your progress.

- Insurance: health, auto, renter’s/home → one accident can wipe out years of savings.

- Digital security: strong passwords, 2FA, and credit monitoring.

Example: A young driver skipped auto insurance. One accident cost $15,000, and his wages were garnished for years.

👉 External resource: FTC – Identity Theft Protection.

Lifestyle & Mindset Shifts

Money management isn’t just math — it’s psychology.

- Avoid “Keeping up with the Joneses.” Competing with neighbors leads to overspending.

- Practice frugal finance: focus on freedom, not flashy purchases.

- Minimalism helps — fewer possessions mean fewer expenses.

Example: One family downsized from two cars to one. They saved $400/month on payments and insurance, and found carpooling actually gave them more family time.

FAQs About Personal Finance

Q1: How much should I save each month?

Rule of thumb: 20% of income. But if that feels impossible, start with 5%. Habits beat perfection.

Q2: Do I need to pay off debt before investing?

Yes for high-interest debt like credit cards. But with student loans, you can invest small amounts while paying them down.

Q3: Is it too late to start in my 40s?

Not at all. Compounding still works. Start today with whatever you can.

Common Mistakes Beginners Make

- Skipping budgets because they “feel restrictive.”

- Carrying credit card balances “for the points.”

- Waiting until you “make more” before saving.

- Hoping for a windfall instead of starting small.

Example: A professional delayed saving until “next year.” Five years later, still nothing. If she’d started with $25/month, she’d have $1,500 plus interest.

👉 External resource: Vanguard – Building an Emergency Fund.

Conclusion: Take Action Today

Here’s the truth: money snowballs, for better or worse. Debt ignored grows into a mountain. But small savings grow into freedom.

Recap of personal finance 101 basics

- Track your spending.

- Build a beginner-friendly budget.

- Start an emergency fund.

- Pay off debt strategically with the right debt payoff strategies.

- Build frugal finance habits and practice smart money habits daily.

- Learn how to start investing with little money and begin early.

- Protect your savings with insurance and digital security.

🚀 Your challenge today:

- Track expenses for 7 days.

- Cancel one unused subscription and move that money to savings.

- Automate at least $20/month into a savings or retirement account.

At Simple Coffers, we believe money should support the life you want — not the other way around. Start small, stay consistent, and let your personal finance 101 money habits shape a simpler, freer future.