How to Use the Sharing Economy to Save Big

Introduction – Why the Sharing Economy Matters

When I moved into my first apartment, I thought I had to buy everything: a couch, a full set of kitchen gadgets, even a power drill for one DIY job. Within months, my budget was straining under barely-used purchases. Discovering the sharing economy—borrowing, renting, and sharing instead of owning—changed everything. I cut costs, reduced clutter, and even built new community ties. For anyone seeking frugal living tips, shared platforms are one of the smartest ways to save money without losing comfort.

The idea isn’t new. But smartphones and apps made it mainstream. After the 2008 financial crisis, many households couldn’t afford cars or big mortgages. At the same time, peer-to-peer technology made it easy to exchange rides, rooms, and even tools. What started small has grown into a trillion-dollar global market. The lesson: frugality plus technology equals freedom.

1) Transportation Without Owning a Car

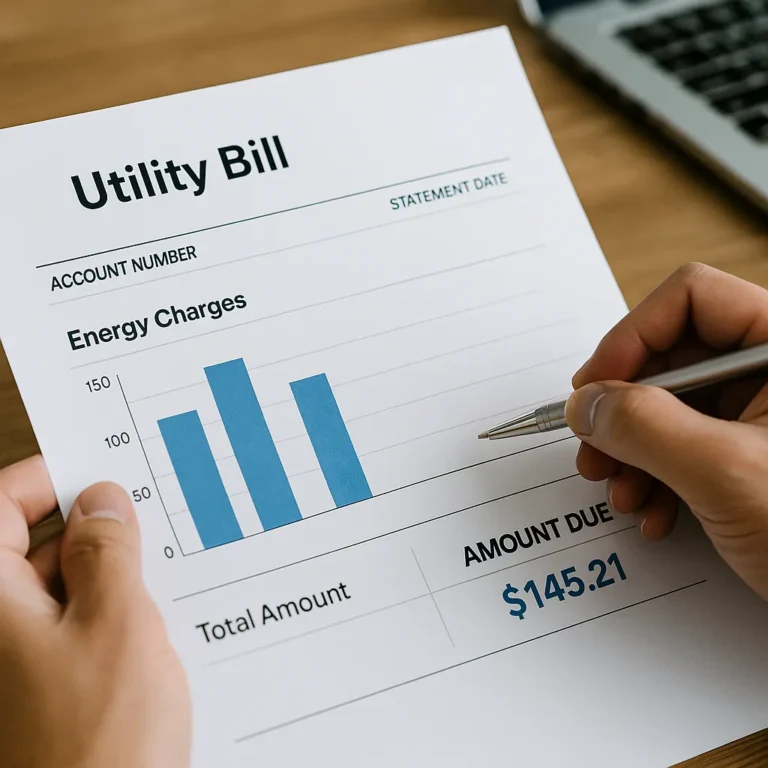

AAA’s 2025 Your Driving Costs shows the average annual cost of owning and operating a new car is $11,577. That’s about $965 a month, down $719 from 2024 but still a heavy expense.

I realized I only needed wheels for errands and trips. Instead of paying for an idle car, I shifted to car-sharing apps (Zipcar, Turo) and ride-sharing (Uber, Lyft).

Callout: Switching to Turo-only weekends freed up ~$180/month—now funneled into my emergency fund.

Quick comparison:

| Expense (per month) | Owning a Car | Sharing Economy |

|---|---|---|

| Loan/Lease Payment | $400–500 | $0 |

| Insurance | $120–150 | Included in fee |

| Gas + Maintenance | $150–200 | $20–40 per trip |

| Parking | $100 | $0 |

| Total | $770–950 | ~$150–200 |

Key point / Watch out: Ride-sharing isn’t always cheaper. Surge pricing can double fares. Always compare the all-in cost (fare + time + parking) before deciding.

Extra example: A co-worker replaced her two-car household with one car plus occasional Zipcar rentals. That cut nearly $4,000/year in insurance, registration, and maintenance.

👉 For more ways to trim recurring costs, check 9 Frugal Living Hacks to Save $100 Every Month.

2) Housing & Travel Savings That Add Up

Accommodation often eats half the travel budget. Airbnb or Vrbo usually undercut hotels. Kitchens also help cut food costs. Couchsurfing even offers free stays. For long-term living, room-share apps can meaningfully reduce rent depending on the city.

On a Portland trip, my Airbnb was $75/night while hotels nearby started at $150. Cooking my own meals saved another $40 a day.

Callout: Seven days = $400+ saved.

Short-term vs. long-term:

- Short stays: Airbnb may add cleaning fees that rival hotel costs.

- Long stays: Monthly Airbnb rentals often include utilities and Wi-Fi—major savings for interns, students, or digital nomads.

- Hotels: Simpler for business travelers, but extras like Wi-Fi and breakfast add up.

Key point / Watch out: Always compare the total price—nightly rate + cleaning + taxes. Cancellation policies for long stays can be strict, so read carefully.

Extra example: A reader shared how she used Airbnb for a 6-month internship. Rent was $1,000 less than downtown apartments, and utilities were included. For students and freelancers, that kind of setup can be a financial lifesaver.

👉 Curious about stretching food dollars? Try Can You Really Feed a Family on $50 a Week?.

3) Tools & Equipment: Borrow Instead of Buy

Most of us own tools or gadgets that sit idle 95% of the time. Instead of buying, look to tool libraries, rental platforms, or local groups (Buy Nothing, Facebook Marketplace) to save money.

During a bathroom remodel, I borrowed a tile cutter from a tool library.

Callout: Borrowed = $150 avoided purchase.

Key point / Watch out: Rentals often require deposits. Take before/after photos to avoid disputes. Check if consumables (like blades) are included or extra.

Extra example: A hobby photographer I know rents lenses from a peer-to-peer platform. Buying the same glass would have cost $2,000. Rentals run about $40 a weekend. For side projects, that’s the difference between trying a passion and breaking the bank.

Environmental impact: Every borrowed tool is one less item manufactured, packaged, and shipped. Tool libraries not only lower costs—they also cut waste and support sustainable DIY culture.

👉 Learn more ways to fix your home without overspending: The Frugal Home: DIY Fixes and Upgrades That Save You Money.

4) Food & Daily Living: Share to Save

Even groceries benefit from shared platforms:

- Food co-ops: Pool purchases for wholesale pricing.

- Community gardens: Grow fresh produce almost free.

- Meal-sharing apps: Affordable home-cooked plates from locals.

I joined a co-op for $10/month and consistently cut 30–40% on staples. A neighbor family swapped two restaurant nights with meal-share dinners.

Callout: Two shared meals/week ≈ $120/month saved.

Key point / Watch out: Consider travel time and pickup schedules. If logistics add stress, savings may shrink. Choose nearby options that simplify your routine.

Extra example: A co-op in my city offers “volunteer hours for credit.” Members who help with stocking or cleaning earn store discounts—sometimes lowering costs by another 10–15%.

Social benefits: Meal-sharing also reduces isolation. Eating with others is linked to better mental health. For many members, it’s not just about money—it’s about belonging.

👉 Batch-cooking hacks here: Beginner’s Guide to Freezer Meals That Save Time and Money.

5) Best Sharing Economy Apps to Save Money (Starter List)

If you’re new, start with these:

- Transportation: Uber, Lyft, Zipcar, Turo

- Housing & Travel: Airbnb, Vrbo, Couchsurfing

- Tools & Goods: Tool Libraries, Facebook Marketplace, Buy Nothing groups

- Food & Daily: Food co-ops, Community gardens, local meal-sharing apps

Tip: Sign up → read reviews → try a small first transaction to test the waters.

Hidden Benefits Beyond Saving

The sharing economy isn’t just about lowering expenses—it reshapes lifestyle:

- Sustainability: Renting reduces waste and demand for mass production.

- Community: Sharing tools, cars, and meals fosters connection.

- Flexibility: Access what you need when you need it; avoid clutter.

- Psychological relief: Living without excess possessions creates a sense of lightness. Many minimalists say shared platforms helped them detach from “stuff” and focus on experiences instead.

And it’s not a blip. A Technavio market analysis projects the global sharing economy to grow by over $1.1 trillion between 2025 and 2029.

From Saving Money to Side Hustle Opportunities

These same platforms can create side hustle opportunities:

- Rent your spare room on Airbnb.

- List an idle car on Turo.

- Offer handyman skills on TaskRabbit.

- Flip unused items on Facebook Marketplace.

A friend turned a spare bedroom into $500/month via Airbnb—$6,000 annually for travel.

Key point / Watch out: Extra income = extra taxes. Track earnings and set aside money for quarterly payments.

Extra example: Another acquaintance drives with Uber a few weekends per month. It covers his $200 gym membership and grocery bills. Side hustles don’t have to be full-time to be worthwhile.

👉 Looking for practical offline hustles? Read 10 Offline Side Hustles You Can Start Without a Computer.

Quick Tips to Get Started (This Week)

- Download one sharing economy app and complete a small trial.

- Compare Airbnb vs. hotel total costs (cleaning, taxes included).

- Join a Buy Nothing group and request one item you’d otherwise purchase.

- Borrow a tool for your next project.

- Try a food co-op or meal-sharing app at least once.

Risks & Hidden Costs (Checklist)

Before every booking or rental, run this three-step check:

- Totals: Compare all-in price (fees/taxes/cleaning) vs. alternatives.

- Timing: Avoid surge hours on rides.

- Proof: Photograph rentals before/after to protect your deposit.

FAQ – Common Reader Questions

Is the sharing economy really cheaper than ownership?

Yes—if usage is light or occasional. Daily commuting or constant use may tip the math back toward ownership.

Which apps help you cut costs fastest?

Zipcar and Turo (transportation), Airbnb and Vrbo (housing), tool libraries and Buy Nothing groups (stuff), food co-ops (groceries).

What hidden costs should I watch for?

Cleaning fees on Airbnb, surge pricing on rides, deposits for rentals, and tax obligations on side hustles.

Does the sharing economy have limits?

Yes. Platforms rely on trust and reviews, and availability can vary by city. In rural areas, options may be limited, making ownership the only realistic choice.

How does this connect to minimalism?

Shared platforms align with minimalist living—less ownership, less clutter, more flexibility. Instead of filling closets, you can “rent as needed,” reinforcing a simple and intentional lifestyle.

Conclusion – Spend Less, Live More

The sharing economy is a practical way to live frugally: access over ownership, community over isolation, flexibility over clutter. From transport and housing to tools and food, you can cut costs without cutting comfort—and even unlock side hustle opportunities.

Frugality isn’t shrink-to-fit living—it’s intentional, smarter choices. Shared platforms prove you can live richer while spending less.

👉 Next up: I’ll share how to slash grocery bills without losing flavor. Bookmark Simple Coffers and join me on this journey. Until then, explore these quick wins: 9 Frugal Living Hacks to Save $100 Every Month.